47+ are mortgage insurance premiums tax deductible

Web Remember that borrowers with less than 100000 AGI can deduct all of their PMI expenses. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Mortgage Insurance Harder To Get The New York Times

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

. However if you prepay the premiums for more than one year in advance for. After this the deduction will not be. Web As of tax year 2021 the tax return youd file in 2022 the amount of insurance premiums youre entitled to deduct begins decreasing by 10 percent per.

However the IRS allows for an exclusion of the first 50000 of group term. Web However in some limited circumstances you may be able to claim a tax deduction when you purchase your insurance plan. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

For example you can deduct the. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. Web So I think the proper amount of the PMI to deduct in 2020 for the old loan is 96 days worth since you held the loan for 96 days before it was paid off.

Be aware of the phaseout limits however. Homeowners who are married but filing. Remember the deduction is only good through tax year 2020.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web No generally you cant claim a deduction for personal mortgage insurance premiums. Ad See how income withholdings deductions credits impact your tax refund or owed amount.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Mortgage insurance premiums and taxes are typically deductible when they are paid by the borrower. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you. Ad Deductions for Healthcare Mortgage Interest Charitable Contributions Taxes More. Taxes Can Be Complex.

If you are claiming itemized deductions you can claim the PMI. 7 years x 365. Typically life insurance premiums are not tax deductible.

Web Mortgage Insurance Premiums and Taxes. Web Tax laws state that you may deduct up to 10000 5000 if married and filing separately of property taxes in combination with state and local income or sales. But for loans taken out from.

Home equity loans and cash-out. Web Assuming 12 payments your deduction is 1200. Web Answer In general you can deduct mortgage insurance premiums in the year paid.

Web The mortgage insurance premium deduction is not permanent in the tax code but it has been extended every year since 2006. This income limit applies to single head of. Web According to the IRS mortgage insurance premiums are tax deductible for amounts that were paid or accrued in 2021.

However higher limitations 1 million 500000 if. The PMI tax deduction works for home purchases and for refinances. Web Originally private mortgage insurance tax deductions were part of the Tax Relief and Health Care Act of 2006 and applied to PMI policies granted in 2007.

In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Prior tax years Mortgage Insurance Premiums you paid for a home where the loan was secured by your first or. Web Eligible W-2 employees need to itemize to deduct work expenses.

Web The PMI Deduction will not been extended to tax year 2022. Everything is included Premium features IRS e-file Itemized Deductions. Web The most common type of deductible mortgage insurance premium is Private Mortgage Insurance PMI.

TaxAct has a deduction maximizer to help find other potential deductions. Web 2 days agoLife Insurance and Taxes. Taxes Can Be Complex.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000. Enter that figure on line 13 of Schedule A.

SOLVED by TurboTax 5832 Updated 1 month ago The itemized deduction for mortgage insurance premiums has. Web Can I deduct private mortgage insurance PMI or MIP. However you may be able to claim a deduction for mortgage insurance.

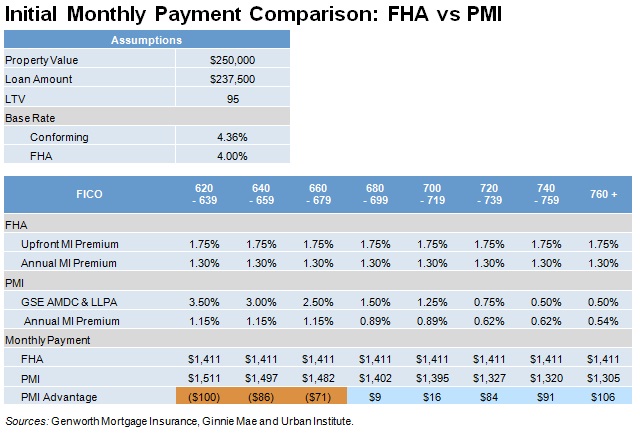

Web Mortgage interest. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web The tax deduction for PMI premiums or Mortgage Insurance Premiums MIP for FHA-backed loans is not part of the tax code but since the financial crisis has.

Is Pmi Tax Deductible Credit Karma

Business Succession Planning And Exit Strategies For The Closely Held

:max_bytes(150000):strip_icc()/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction

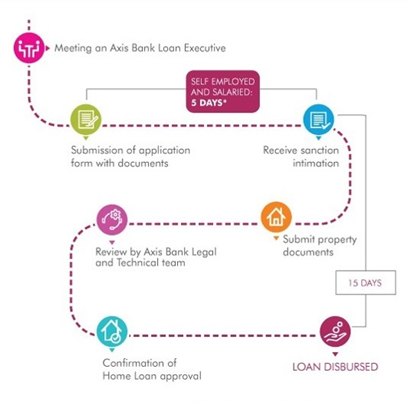

5 Things You Did Not Know About Personal Loan Axis Bank

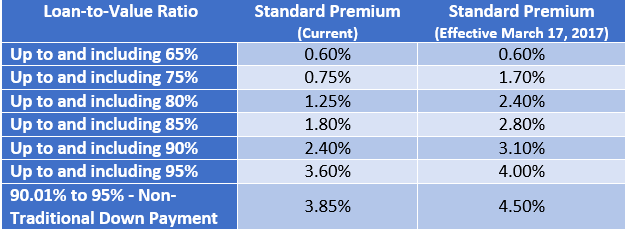

Mortgage Insurance Rates Are Going Up Here S What You Should Know Educators Financial Group

Is Mortgage Insurance Tax Deductible Bankrate

X8gre0xvziru3m

5 Types Of Private Mortgage Insurance Pmi

Is Mortgage Insurance Tax Deductible Bankrate

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

What Is Pmi Understanding Private Mortgage Insurance

Upfront Mortgage Insurance Premium Is It A Deduction

Home Loan Apply Housing Loan Online Rs 787 Lakh Emi Axis Bank

Can You Deduct Mortgage Pmi On Your Tax Return Pinewood Consulting Llc

Things To Keep In Mind Before Buying Unit Linked Insurance Policies Ulips Online

Is Private Mortgage Insurance Pmi Tax Deductible

How Does Your Credit Score Affect Your Personal Loan Application Axis Bank